Trump’s Week of Trade Diplomacy in Asia

Innovation, Creative Destruction, and the Economics of Sustained Growth

October 15, 2025Introduction

Donald Trump’s high-stakes Asia tour closed with Kuala Lumpur at the center of global attention, turning a routine regional summit into a stage for strategic power play. What began as an ASEAN-focused engagement quickly transformed into a wider diplomatic push across Japan, Vietnam and Thailand, signalling Washington’s intent to reclaim influence in a region where China’s economic reach has grown steadily.

During the summit, Trump finalized trade agreements with Malaysia and Cambodia and entered into cooperation frameworks with Thailand and Vietnam. At the same time, China advanced its own position by upgrading the ASEAN China Free Trade Area, strengthening its offer of an alternative economic integration model. For global corporations and investors, these developments redefine expectations for sourcing, compliance, competitive positioning and market access. Understanding how these agreements operate helps identify where early impacts will emerge and how strategic alignment is becoming central to commercial decisions.

Trump’s Agenda: Trade, Diplomacy and Influence

The U.S. approach during the tour consolidated three major pillars: trade expansion, diplomatic signalling, and influence-building through supply-chain restructuring.

Trade:

The United States completed binding trade agreements with Malaysia and Cambodia and secured framework pacts with Thailand and Vietnam. These instruments cover tariff pathways, non-tariff issues such as SPS measures and labour standards, and cooperation in critical minerals and investment screening. They also reflect Washington’s intent to embed economic security considerations into traditional market-access discussions.

Diplomacy:

Trump’s role in brokering the Thailand–Cambodia border peace accord underscored that trade diplomacy in Southeast Asia is inseparable from regional security. Stability at land borders directly influences logistics corridors and overland supply routes that global corporations rely on.

Influence:

A core emphasis of the agenda was supply-chain resilience. ASEAN members such as Malaysia and Thailand were identified as potential partners in critical-mineral processing and electronics manufacturing, aligning them with U.S. standards. This marks a shift away from cost-based sourcing toward frameworks defined by trusted partnerships, traceability and strategic alignment.

These pillars show that the U.S. approach is not simply an economic engagement strategy but a broader attempt to embed the region in a standards-based architecture aligned with American interests.

With the agenda in place, we can now examine the trade tools and market moves that will emerge from it.

The Trade Dimension: Deals, Tariffs and Market Moves

The summit outcomes present a clearer picture of the mechanisms that will shape corporate strategy in the near term. Agreements with Malaysia and Cambodia now cover a large portion of U.S. ASEAN trade and introduce tariff pathways that include possible zero-tariff carve-outs for select sectors. Base tariff rates remain high, and this alone creates a degree of uncertainty for exporters until specific carve-out lists are released.

Major trade instruments and market signals:

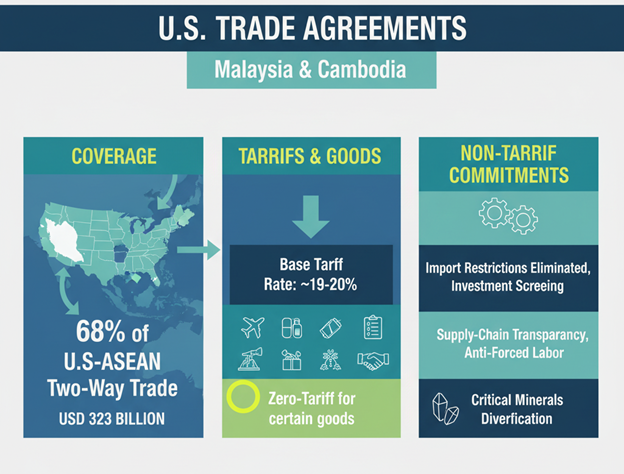

- The U.S. agreements with Malaysia and Cambodia cover an estimated 68 % of U.S.–ASEAN two-way trade, representing an estimated USD 323 billion.

- Under the deals, the U.S. maintains a base tariff rate of about 19 % (for Malaysia, Cambodia) and 20 % (for Vietnam), with the possibility of zero-tariff carve-outs for certain goods such as aircraft parts, generic pharmaceuticals, specialised natural resources and certain agricultural goods.

- Non-tariff commitments include elimination of certain import restrictions, aligned investment screening, rules for supply-chain transparency, co-operation on forced labour standards, and critical-minerals diversification.

- Importantly, while the deals provide doorways, they leave significant ambiguity: for example, no detailed rules around transshipment (i.e., routing of Chinese origin goods through third countries) or semiconductors were included.

Long term impacts if these mechanisms materialise:

- Exporters in Malaysia, Cambodia, Thailand and Vietnam that align with U.S. frameworks may gain improved access to the U.S. market for specific product lines where carve-outs apply. This could increase revenues and improve margins if they can meet origin and compliance requirements.

- Supply-chain manufacturers (electronics, automotive, consumer goods) that previously relied on low-cost “China+1” models may find their margin structures under pressure, because U.S. tariff equivalencies remain and origin rules may tighten. Firms may need to adjust by shifting inputs, revalidating origin documentation, or increasing value-added content locally.

- For sectors tied to critical minerals, aerospace and advanced energy, new deals signal potential project pipelines in ASEAN. For example, Malaysia and Thailand may become host locations for critical-minerals processing destined for U.S. firms, opening contract flows and investment opportunities.

- Conversely, companies with heavy exposure to U.S. import tariffs, ambiguous origin status or supply chains routing via China may face margin erosion, supply-chain disruption, or cost increases on compliance and auditing.

These trade developments must be understood in the wider geopolitical shift, because state power is increasingly linked with commerce.

Geopolitics in Motion: Regional Power Shifts

The agreements finalised during the tour have brought renewed clarity to the power competition in Southeast Asia. While the United States has reasserted itself through trade deals, security diplomacy and supply-chain alignment, China has strengthened its foothold through the upgraded ASEAN China Free Trade Area. This dual architecture means that ASEAN states must weigh economic integration against strategic flexibility.

Concerns about sovereignty are already visible. In Malaysia, voices within policy circles have warned that deep alignment with U.S. frameworks may lead to constraints linked to third-country sanctions or regulatory expectations. At the same time, China’s expanded free-trade pact has been welcomed by several ASEAN countries that view it as a stable and predictable channel for economic growth.

Although important agreements have been signed, the region now enters a period where implementation timelines, political change and regulatory capacity will determine outcomes. Implementation will take months and possibly years, and firms will need to plan for a multi-speed environment. With this geopolitical backdrop in place, attention shifts to the actual impacts now unfolding and those likely to shape strategic choices moving forward.

Risks and Opportunities for Business and Policy

The days immediately following the summit have already revealed how governments and corporations are responding to the new landscape. Malaysia has begun reviewing its investment screening and the role of high-exposure Chinese inputs in advanced manufacturing. Cambodia has initiated early tariff adjustments for U.S. goods. These rapid steps indicate that the agreements are already altering national regulatory behavior. On the Chinese side, the introduction of CAFTA 3.0 has been followed by invitations to ASEAN members to accelerate participation in digital payment systems and renewable-energy supply chains. Countries such as Indonesia and Laos have shown early interest, suggesting that China is moving quickly to anchor its influence.

Corporate impacts are emerging with equal speed. Manufacturers in Vietnam, Thailand and Malaysia have initiated audits of their supply chains to determine where Chinese-origin inputs may create future exposure under stricter U.S. origin rules. For companies with established sourcing ties through China plus one models, the need to reassess origin risk has become both immediate and unavoidable. Firms in the semiconductor, electronics and automotive value chains are particularly sensitive to this, given the heightened scrutiny anticipated in those sectors.

The national impacts also vary. The United States strengthens its position in critical sectors such as minerals, advanced electronics and defense-linked manufacturing, although it also assumes the challenge of enforcing standards across multiple jurisdictions. China experiences a mix of strengths and vulnerabilities. CAFTA 3.0 significantly boosts its economic influence, especially in green technologies and digital services, but it must now compete more actively for supply-chain loyalty in a region that is increasingly balancing rather than band wagoning. For India, the environment presents both risks and opportunities. India faces competitive pressure in manufacturing, particularly in electronics, where Vietnam and Malaysia currently attract more investment. However, India can benefit from the global effort to diversify away from China, provided it accelerates reforms and enlarges industrial capacity.

Across ASEAN, impacts will not be uniform. Malaysia, Thailand and Vietnam stand to gain from early alignment with U.S. initiatives, especially where compliance capability is strong. Smaller economies such as Laos or Myanmar may gravitate more naturally toward the Chinese architecture because they lack the institutional readiness required by U.S. frameworks. Cambodia gains tariff access to the U.S. but must navigate the long-term challenge of diversifying beyond reliance on Chinese capital.

Overall, the unfolding developments suggest that companies must prepare for a more fragmented and dual-track regional economy. Regulatory coherence will be uncertain and the ability to demonstrate compliance will increasingly determine competitiveness. These realities set the stage for understanding how businesses and governments can position themselves strategically in a region where commercial decisions are deeply intertwined with geopolitical orientation.

This leads naturally to the next chapter, which focuses on sector-positioning, investment strategy and the role of alignment in long-term planning for both corporations and policymakers.

Intueri Insights for Business

- For exporters in Southeast Asia: the trade deals indicate that countries like Malaysia, Cambodia, Thailand and Vietnam are now being integrated more closely into U.S. trade frameworks. That means such companies may find U.S. market access improved but also subject to closer U.S. oversight and supply-chain criteria.

- For manufacturers and supply-chain participants: critical-minerals, technology and supply-chain resilience are emerging as priority themes. Companies situated in ASEAN with capability in processing or servicing U.S.-aligned demand may see strategic advantage.

- For investment and sourcing decisions: the conference signals that location decisions will increasingly incorporate strategic alignment (which country is in the U.S. trade-framework orbit), supply-chain origin risk, tariff exposure and regulatory alignment, not just labour cost or logistics.

- For governments and public-sector stakeholders: countries participating in these new U.S. frameworks are likely to see shifts in trade architecture, investment patterns and regulatory expectations (investment screening, export-controls). Corporate stakeholders must monitor how those changes affect sectoral access, market entry and sourcing.

End Note

Trump’s Asia tour marks the beginning of a new phase in trade and geopolitical architecture in the Indo Pacific. The agreements and frameworks introduced are more than diplomatic outcomes. They signal long-term shifts in supply chains, market access, regulatory expectations and strategic choices across the region.

Companies will need to monitor how rules of origin are implemented, how tariff carve-outs are structured, how critical-mineral infrastructure evolves and how ASEAN nations navigate the competing pressures of Washington and Beijing. What has been agreed today will shape cost structures, investment decisions and competitive dynamics in the months and years ahead. Firms that act early, deepen compliance capabilities and position themselves within the evolving regional frameworks will gain the strongest foothold as the new landscape takes shape.