Developing an effective workforce restructuring strategy amidst a global crisis

Supply Chain Resilience Initiative (SCRI)

May 3, 2020

Medical Devices Industry of India

July 14, 2020Introduction:

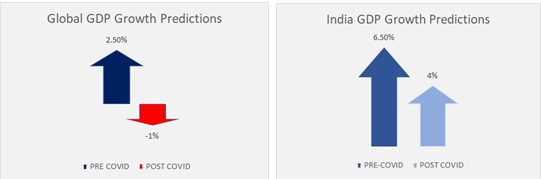

Covid-19 has delivered a severeblow to an already fragile global economy,crippling global supply chains&adversely affecting every firm, sector & nation in its wake. Recovery hopes, at least for the short term appear grim: the economy is expected to go into recession through 2020-21, with the economy expected to contract by as much as 1% of GDP, according to the analysis by the UN Department of Economic and Social Affairs (DESA). This is a sharp downward revision from the previous estimate of 2.5% global growth.As for India, its economic growth is likely to slow down to 4 per cent this fiscal on the back of the current global health emergency according to Asian Development Bank (ADB), with a negative GDP growth for the final quarter of Fy20.

Under these circumstances a number of firms have currently found themselves in a bleak economic landscape, with sharp slowdown in demand, with recovery nowhere in sight and a cost structure that is unsustainable.

For now, the financial markets have taken the brunt of the global risk-off sentiment. However, as time passes, the effect of demand slowdown and drop in consumption will be felt by the majority of the industries and firms, with a number of these firms already precariously placed even before the covid crisis began.

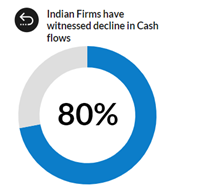

Statistics and figures bear out the difficult predicament of Indian corporates. A survey by FICCI stated that over 50% of Indian companies have experienced negative impact on their operations and nearly 80% have witnessed a decline in cash flows due to the pandemic.

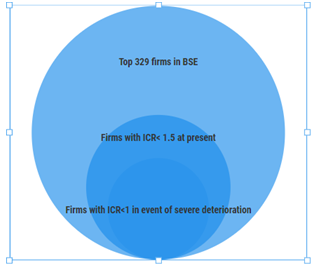

Further, Indian companies are under severe stress to service their debt obligations, according to McKinsey & Company on the indebtedness of Asian corporates.The share of debt with interest coverage ratio of less than 1.5 times of operating profits stood at 43%, even before the covid19 led crisis took hold. The low interest coverage ratio shows that a large part of the earnings is going to service debt and as such decline in operating earnings and operating cashflows could rapidly constitute an existential crisis for the firms in questions

Need for a Workforce restructuring strategy:

Given such a perilous situation and given that recovery appears to be beyond the immediate horizon, a number of Indian corporates are either facing or imminently about to facea series of cascading emergencies requiring urgent interventions, with layoffs and workforce restructuring being one of the many importantdecisions required as firms battle for survival. Under these circumstances, there is often a need for fast decisions, generally translating to rushed, poorly thought out, inefficient, inadequate decisions which then require subsequent corrections, in the process hemorrhaging firm reputation across the workforce community and decimating workforce morale across surviving members.

Consider NerdWallet. It started 2017 as a San Francisco Business Times Best Place to Work. Then it administered three rounds of layoffs. It ended 2017 with a tarnished employment brand and a Glassdoor profile filled with comments about how having three rounds of layoffs in one year “has crashed the company morale.”

Additionally, executives tend to delegate such unpleasant, often thankless decisions to individual business units/verticals and lower level managers instead of developing a comprehensive, coordinated approach across the company and group companies. As a result, it is not uncommon to find a firm laying off an employee and then hiring for the same skill set in another part of the organization, in the process wasting additional time, money and resources for no net gain.

Nearly all of this can be avoided through the development and implementation of a cogent, structured workforce restructuring strategy that is in alignment with the firm’s immediate and medium-term goals. It can mean the difference between survival and collapse. It can also mean the difference between disgruntled employees, emotionally scarred workforce and a dignified separation. This article looks at the key factors to consider when developing a workforce restructuring strategy.

Key factors to consider

Develop a comprehensive strategy for the crisis period and beyond:

There is a strong temptation to think of workforce restructuring in isolation. Typically, firms turn to episodic restructuring based on short sighted strategy, or even on hope, prayers and wishful thinking as the basis of workforce restructuring.This is especially true in periods of crisis, when executives are firefighting a series of emergencies, which has the effect of narrowing the field of vision away from the big picture and strategy towards the individual decisions and the tactical.

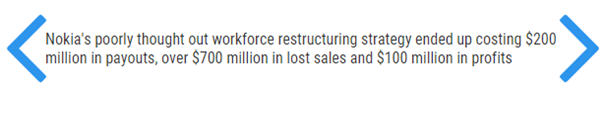

Consider the case of Nokia. At the beginning of 2008 senior managers at the Finnish telecom firm were celebrating a one-year 67% increase in profits. Yet price-based competition from low-cost Asian competitors, and increase in labor costs by 20%convinced management to layoff the German plant’s 2,300 employees, angering employees over perceived injustice, ultimately costing Nokia €200 million—more than €80,000 per laid-off employee—not including the ripple effects of the boycott and bad press. The firm’s market share in Germany plunged; company managers estimate that from 2008 to 2010 Nokia lost €700 million in sales and €100 million in profits there.

There was no real long term or well thought out strategy as the bedrock for this corporate decision. Workforce restructuring became the end in itself, as opposed to being the means to an end. It is entirely possible that a well-developed, well thought out corporate strategy might have led to the same conclusion regarding workforce restructuring strategy. However, odds are such a broad level strategy would have recognized the dangers and risks of the plan, and managed the situation better, mitigating the needless fallout.

It is the view of Intueri that any workforce restructuring decision must further the firm’s broader strategic goals and objectives, and that workforce restructuring strategy is the means to an end. This requires that the restructuring strategy be in alignment with firm strategy, which in turn requires a cogent, comprehensive strategy for the firm, both for the crisis period and beyond.

An effective, well thought out broad level strategy will enable decision makers to develop restructuring strategies that best meet the objectives and goals of the strategy and thus by extension, have the best possible impact on a firm’s battle for survival.

Centrally assess resource requirements and develop restructuring strategy at a central level

Construction GMBH (name changed) is an Indian EPC firm. A few years ago, one Business Unit of the firm conducted a major workforce revision, resulting in the layoff of several thousand employees, mostly for reasons of redundancy. Roughly at the same time, other verticals of the firm were conducting large scale hiring. There was no coordination between the different vertices of the firm on the question of employee management. Consequently, roles that could have been filled up with internal transfers had to be hired externally. Competent employees with years of organizational knowledge, core expertise and on whom the firm had spent several hundred thousand rupees were lost to the firm. This also caused resentment among the employees, and poor optics for the firm.

This could have been avoided by conducting a workforce requirements audit at the central/firm level before moving ahead with the layoff. Intueri understands that a detailed audit of the workforce may not be possible or feasible in the current crisis. However, a quick and dirty assessment, carried out by mid-level line managers and below, when aggregated and utilized to guide workforce decisions could be substantially effective in optimizing workforce internally, saving the firm time, money and resources that would have otherwise been spent on external hires. It would also keep individuals with firm specific skills, thus avoiding the cost of training up the new hires.

Consider Alternatives to layoffs

Workforce restructuring is not without its own risks. There is no guarantee that the objectives the executives set out to meet through layoffs will be met, or that the firm will benefit from layoffs. Often, the end results are entirely in opposition to expectations.

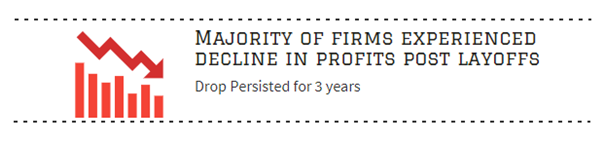

In a 2012 review of 20 studies of companies that had gone through layoffs, Deepak Datta of Arlington University, Texas discovered that after layoffs a majority of companies suffered declines in profitability, and a related study showed that the drop in profits persisted for three years. (HBS)

Additionally, companies that shed workers lose the time invested in training them as well as their networks of relationships and knowledge about how to get work done. Valuable time is lost as surviving employees reorient themselves and reestablish these networks. This can have real consequences in a crisis scenario, where time is at a premium. Further, while short-term productivity may rise because fewer workers have to cover the same amount of work, that increase comes with costs in terms of quality and safety, as also the heightened danger of risk creep in operations as fewer people manage much more resources andresponsibilities. The increased workload and low morale following a layoff has been known to cause increase in workforce attrition and turnover amongst survivors. There’s also the question of the effect on a company’s reputation: E. Geoffrey Love and Matthew S. Kraatz of University of Illinois at Urbana–Champaign found that companies that did layoffs saw a decline in their ranking on Fortune’s list of most admired companies. (HBS)

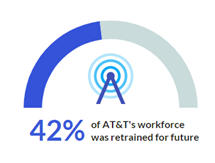

On the other hand, innovative, long term vision-based workforce restructuring can provide real gains. ConsiderAmazon: it will invest US$700 million to retrain 100,000 employees—a third of its U.S. workforce—in new technologies. This way, the company protects the knowledge and the internal networks the employees have developed while bringing the workforce up to speed. AT&T is another example. It retrained over 100,000 employees who were stuck in jobs in danger of becoming redundant. The results seem very positive: 18 months after the program’s inception, the company had decreased its product development cycle time by 40% and accelerated its time to revenue by 32%. Since 2013, its revenue has increased by 27%, and in 2017 AT&T even made Fortune’s 100 Best Companies to Work For list for the first time.

Intueri believes that firms should, unless absolutely necessary, avoid the temptation of layoffs and focus on alternative workforce restructuring strategies. In the long run, the benefits could substantially outrun the incremental costs.

Ensure dignity to workforce

Layoffs are difficult, unpleasant, unpopular, thankless,even highly risky decisions to communicateto the workforce and as such most managers tend to take a hands-off approach, with as little emotion as possible, completely avoiding the often devastating psychological impact on the workforce, both on the ones being let go as well as the survivors. Often managers are so fearful of erring on the wrong side, they will read out a prepared corporate speech, or even send an impersonal mail, dispassionate in tone and dehumanizing in approach, making employees feel like they were just anotherstatistic. This dehumanization at times is compounded by other humiliating experiences, such as having guards escort employees off the campus, denying employees their basic dignity.

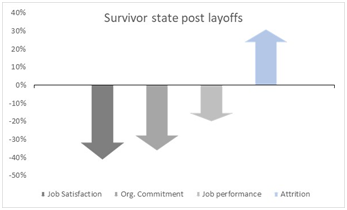

Even the employees who survive the restructuring do not escape unscathed, with a large number demoralized by the loss of friends and colleagues due to the restructuring, and worried abouttheir ownjob security in the days to come. This is particularly true in case of a poorly executed, rough restructuring exercise where employees feel their dignity was denied. Consequently, according to Harvard, survivors on average experienced a 41% decline in job satisfaction, a 36% decline in organizational commitment, and a 20% decline in job performance.University of South Carolina found that downsizing a workforce by 1% leads to a 31% increase in voluntary turn over the next year.

(HBS)

Studies have shown that when firms take their employees into confidence, and when firms take measures, that show they care, they reduce the anger, the hostility and negative emotions and even soften the extent of the psychological blow associated with the layoff. Taking a more human-like approach not only minimizes survivor guilt, but it helps with morale, productivity and makes those let go feel like they were truly cared for (HBS)

1.Take the workforce into confidence: it is astonishing as to how many firms are loath to take their own employees into confidence. There is almost a juvenile tendency to keep information away from employees, leading to nervousness and restlessness amongst the employees, the ideal breeding ground for rumors and conspiracy theories which only serve to enrage and bring down the morale of the workforce.

Taking employees into confidence, from an early stage, would ensure that employees have sufficient information on the situation. When workers understand the why behind a company’s decision it increases their trust in the company and doesn’t take a toll on their self-confidence.

2. Communicate effectively & decisively: it is crucial that the entire management team is on the same page and has developed and implemented a comprehensive communication strategy. It is important that the firm be honest,transparent, open and timely in their communication, and avoid impersonal communication methods like email. In fact, according to a number of experts, the worst thing a company can do is blindside their workers and conduct layoffs through an email.

3. Help Employees move on in their careers: Firms should consider assisting employees beyond the legal mandate: a severance package or other benefits. Managers should offer to write letters of recommendation for their reports. Firms could and should offer to assist the employees being let go in finding their next jobs. These gestures help show to the employees that the firm cares.

4. Show Empathy: The process of layoffs, designed to protect the firm, can feel very mechanical and impersonal, at a point in time when employees are going through a stressful, emotionally vulnerablephase.

Empathy costs the firm nothing but can reap rich dividends if done right. Employees talk amongst their colleagues and friends across firms. if they feel they are treated in an undignified manner, word will travel across their networks and through online reviews about the company and their experience. Empathy can make the difference between a tarnished reputation and a trustworthy reputation in the recruitment market.

5. Securesurviving workforce morale: Layoffs, even when executed in the best possible manner, can cause employees to feel they’ve lost control: The fate of their peers sends a message that hard work and good performance do not guarantee their jobs.This could have the impact of reducing long-term productivity, causing a deterioration in Quality,safety and supervision standards and increase of employee burnout and turnover rates. It is essential that firms do all they can to ensure morale of the survivors remains high. The very survival of the firm depends on these chosen employees. Practices such as having counsellors to help employees deal with the fallout, guilt of restructuring , having an open organizational culture where information is freely shared, and taking the employees into confidence regarding the firm’s condition are among the vast set of measures that management should consider to secure workforce morale.

Be Aware of the Danger of risk creep: Risk creep is a term that describes the insidious and unrecognized increase in risk that occurs despite every effort to mitigate risk or avoid it. Risk creep is one of the most difficult aspects of the risk management process to truly understand and manage. It is also rarely considered when planning workforce restructuring despite the potential for catastrophic losses from an inadequate management of risk creep.

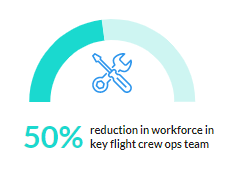

Consider Boeing: Dennis Meulenberg demanded price concessions from suppliers, heaped more cost demands on engineers, and cut the workforce about 7 percent while making many more planes during his tenure as CEO.

Employment in the flight crew operations team, the team that managed how pilots interacted with the plane’s software and controls—the very issue suspected of flummoxing crews in the Lion Air and Ethiopian Airlines tragedies, had been cut in half, from 30 to 15 over 5 years. Employees testified to intense low morale because of all the layoffs—constant, grinding layoffs, year after year, forcing them to watch their step and be careful about what they said. Similar cuts were carried out at key engineering teams, all under the implied assumption that the reduced team would lead to increased efficiency while risks remained manageable. Unfortunately, the reduced workforce, combined with increased responsibilities and targets meant that corners had to be cut by the teams. Each step of cost cutting, and workforce restructuring caused an incremental rise in operational risk to the firm and its products, i.e. risk creep, which went unnoticed by the workers and management until the final catastrophic failure. It does not mean that risk creep was solely responsible for the events that led up to the twin Boeing 737-Max crash. But risk creep did play a major role in it.

FAA (Federal Aviation Agency) is itself another example of a firm inflicted with risk creep brought about by continuous workforce restructuring and cost cutting. The workforce was reduced to the extent that it became impossible for FAA to conduct necessary checks on its own, and they began to rely on Boeing for assessments that should have clearly been conducted internally. This in large part contributed to the lack of effective oversight that could and should have prevented the twin crashes.

History is full of company examples where this philosophy of operating risk creep follows through, often silently, to the point of putting the company at legal, reputational and financial risk beyond the likelihood of recovery. The biggest challenge with managing and mitigating risk creep is that it can be almost impossible to measure incremental risk of individual decisions, and thus be undetected until failure. As such, it must be considered integral to decision making such as workforce restructuring.

Summary

The Global and Indian corporates are in a difficult predicament; supply chains have been disrupted; economic activity battered. The world economy has ground to a halt and slipped into recession. The end of the COVID-19 crisis appears nowhere in sight and even thoughts of recovery stretch well beyond the immediate horizon. In these circumstances, a number of firms find themselves in an existential crisis. For a number of these firms, some form of workforce restructuring, even the dreaded layoffs, will be inevitable. For others, layoffs will be a strong temptation as cash inflows slow and costs begin to bite. Intueri advises that workforce restructuring be part of a larger corporate strategy, aimed at managing the firm through these difficult times and through the early recovery period. It is the belief of Intueri that workforce restructuring is the means to an end and must not be considered an end in itself. Intueri further advises that firms avoid workforce layoffs unless absolutely necessary given their pernicious effect on the firm and its employees. If layoffs are inevitable, Intueri asserts that such a decision and strategy be devised at a centralized level, taking into account the requirements of the entire firm/group company. When layoffs must be carried out, Intueri strongly advocates that the firms must treat their workforce with the dignity and empathy they deserve. Finally, Intueri warns of the dangers of risk creep arising as a consequence of workforce layoffs.

References/citations:

- https://www.entrepreneur.com/article/307308

- https://www.forbes.com/sites/heidilynnekurter/2020/03/31/3-ways-to-layoff-employees-with-dignity-during-a-crisis/#27acc1422f7f

- https://www.fastcompany.com/90380050/amazon-upskilling-100000-employees-and-the-future-of-work

- https://hbr.org/2018/05/layoffs-that-dont-break-your-company

- https://qz.com/work/1663731/mass-layoffs-a-history-of-cost-cuts-and-psychological-tolls/

- https://www.randstadrisesmart.com/blog/layoffs-dignity-preserving-employee-relationships-easing-transitions

- https://www.researchgate.net/publication/243462383_Strategic_downsizing_Critical_success_factors

- https://www.lexology.com/library/detail.aspx?g=6200f1d7-1bbe-4093-8692-48984bd7d958

- https://www.nytimes.com/2015/01/08/business/in-assessing-2015-goals-be-wary-of-risk-creep.html

- https://ui.adsabs.harvard.edu/abs/2010ESASP.680E.104G/abstract

- https://www.bloomberg.com/news/features/2019-05-09/former-boeing-engineers-say-relentless-cost-cutting-sacrificed-safety

- https://fortune.com/longform/boeing-737-max-crisis-shareholder-first-culture/

- https://www.panorama-consulting.com/alternatives-to-layoffs/

Authored by: Bikash Sarkar, Associate Consultant

About Intueri: Intueri Consulting is a management consulting firm with nearly 100 man-years of experience in managing organizational challenges, including managing firms and clients through some of history’s biggest crisis periods such as the 1997 Asian Financial Crisis, 9/11 led crisis, 2007-08 global financial crisis. This vast repository of organizational management experience, accrued by senior management, over decades of managing large multinational firms and clients enables Intueri to develop effective, efficient crisis management strategies and provides it with a unique perspective into events and decisions that take into consideration all important aspects of a firm, including assessment of primary, secondary and even tertiary order potential effects on the firm on account of implementation of strategies. Intueri has been helping organisations enter new areas within the chemical sector in order to diversify their product mix with the help of existing players who are looking to buy something they need or to sell something that they make. The firm has consultants with extensive domain knowledge both in the chemical and pharmaceutical sector.