Fundraising action plan for startups amidst the Covid-19 induced uncertainty

Effect of COVID-19 on Indian Manufacturing Sector and Opportunities for Future Growth

March 26, 2020

Opportunities in the Indian Pharmaceutical Sector Post COVID-19

April 22, 2020Objective

Introduction

Introduction

Post the 2008 recession, three recently founded startups decided to brave the superlatively bearish sentiment of the economy and developed a blue ocean strategy to enable consumers to try their innovative services. Consumption was remarkably low, translating to restrictive spending and ‘wise’ usage of capital. In such a period, investors and fund houses were difficult to approach for fundraising applications. A significant portion of investors fell short of wealth and even the ones ‘open for business’ were stringent in their due diligence or demanded a higher stake in the ownership. Despite all odds, these three firms stuck to their core value proposition and kept a continuous focus on user satisfaction and strived hard to keep the ‘wow’ factor alive in their product. Post their first funding rounds in late 2008 or early 2009, they have been hunted around by the most glamourous of the fundraising community. At present, quite a few of the mightiest global financial sponsors have parked their funds with them.

Spotify, AirBnB and Uber, thus, acts as pillars of inspiration for businesses to sail through an economic collapse and raise capital during uncertain times.

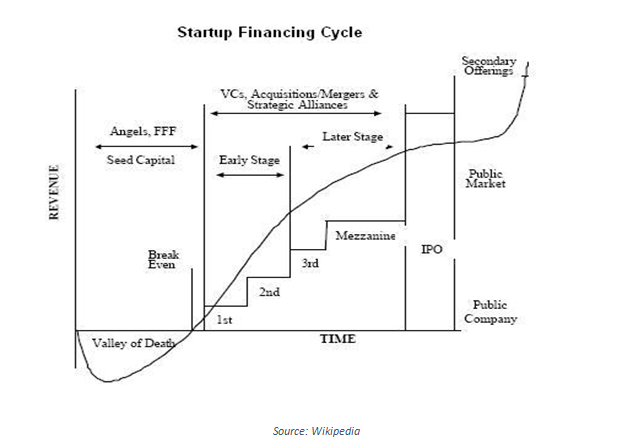

The above diagram represents the journey of fundraising for an organization from foundation stage to IPO. As depicted, although revenue correlates with the accumulation in funding, the revenue curve gradually flattens with time, till the firm surfaces for an IPO. So, the Early Stage phase (primarily up to Series B phase) behaves as a chief architect of its growth.

Amidst the ongoing crisis, the number of seed deals and early-stage funding deals fell 37% to 228 in the first quarter of the year that ended March 31, as compared to the same quarter the previous year . Several deals under process have been abruptly stopped with the implementation of the “force majeure” clause.

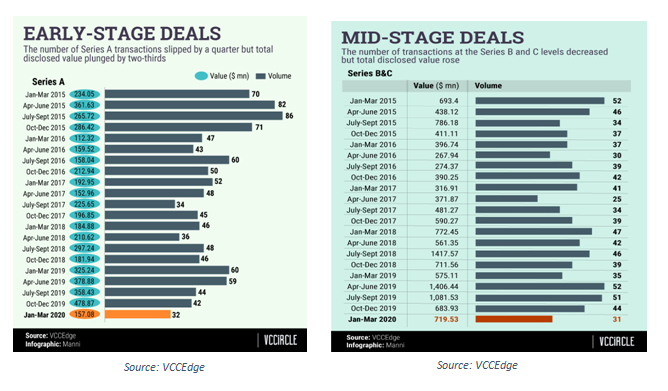

In the first quarter of 2020, the number of Series A deals plunged to 32, the lowest level since the beginning of 2015. This compares with 42 deals struck in the October-December quarter and 60 deals recorded in the same quarter in 2019.

The number of Series B and C deals decreased to 31 in the first three months of the year from 44 in October-December and from 35 in the same period last year.

As quoted to the Economic Times, a Bengaluru based Fintech firm’s founder describes his experience to raise 5 Million USD. He says: “We were in the due diligence stage and most things were done. Suddenly, I received a joint call from both funds to understand my take on the Covid-19 virus outbreak and its impact on our startup”.

COVID-19 spread in India has pushed the banking sector to one of the darkest phases of business lending in its history. Corporate leadership across sectors, irrespective of the size of the organization, has requested an extension of the current 3- month moratorium period. In March 2020, financial sponsors such as major PE/VC firms have collaboratively issued a statement of caution for the registered startup founders in the country. The focus has shifted from growth to cost minimization, and runway extension.

A pessimistic, unfavourable scenario has thus emerged in the fundraising community and this may persist, as far as current expectations, for at least a couple of quarters ahead.

So, here we address the question of how to raise interim capital for startups in the trough cycle.

Inclusion in various schemes of RBI or the Government

The commerce minister Mr. Piyush Goyal met several industry stalwarts and venture capitalists to discuss on a startup relief package to fight the economic downturn caused by the pandemic. Businesses may need to be registered under the Department for Promotion of Industry and Internal Trade (DPIIT) to avail of the much-needed benefits. A significant portion of the Fund of Funds (FoF) corpus of Rs 10,000 crore may be provisioned for disbursement. A petition has also been filed to the government to reimburse 50% of the salaries for a month and to be offered a 20-lakh grant each.

RBI, on the other hand, has received proposals from ministry officials to release a separate bailout package for startups and MSMEs and hopefully, they might be in the rollout planning phase. The decrease in repo rate by 75 basis points shall increase the supply of capital. Although industry believes catering to demand is an arduous task in such extraordinary times.

There might be a silver lining though.

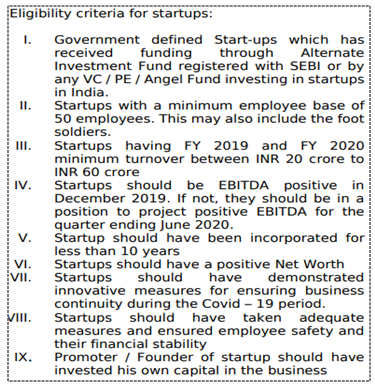

Small Industries Development Bank of India (SIDBI) has launched a Covid-19 Startups Assistance Scheme (CSAS) where government defined startups, based on the below-mentioned eligibility criteria, can receive up to INR 2 crores each for Working Capital Term Loan. Amidst the current crisis, SIDBI has pivoted from equity financing to credit financing.

Startups must scrutinize the various terms and conditions mentioned here before applying for the scheme.

Moreover, the Indian Private Equity and Venture Capital Association (IVCA), the representative body for risk capital in India, has proposed that SIDBI increase the maximum limit of loan amount up to Rs 5 crore, from the currently proposed Rs 2 crore,reduce the interest rate, and ease the criteria that currently allows only unit economics-positivestartups to be eligible to apply for CSAS, along with a longer payback duration.

The loan tenure has been provisioned for up to 36 months with a moratorium period of maximum 12 months. But the new IVCA proposal has requested for a tenure up to 48 months and moratorium period of 18 months.

Businesses may soon avail eased out policy waivers in export expenses, logistics and shipping costs, regulatory compliances and hopefully, tax reductions. These may immensely help business models extend their runway without slashing jobs or salaries.

![]()

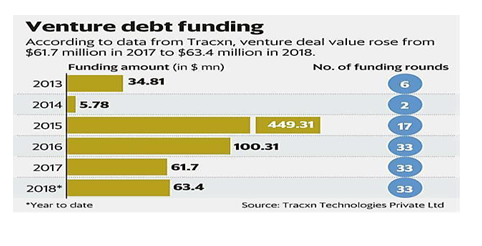

Venture debt financing

Venture debt firms are specialised institutions catering to debt financing needs for startups. In India, Innoven Capital, Alteria Capital and Trifecta Capital occupy the lion’s share of this market with a collective deployment of 300 Million USD in 2019.

Besides runway extension and a hefty tax shield based on interest paid on debt, founders and leadership team can leverage the freedom of not having to dilute the ownership for a temporary crisis. Moreover, a deferment of EMIs may be granted if the situation worsens to an unprecedented level. Post crisis, the funds raised from equity can be restructured into a preferential arrangement to pay off the debt, easing financial distress between the lender and the lendee.

Venture debt expect a cumulative return of 12-25%, including loan interest and capital returns.

Typical loan terms seen in the industry are as follows:

• Repayment: ranging from 12 months to 48 months. Can be interest-only for a period, followed by interest plus principal, or a balloon payment (with rolled-up interest) at the end of the term.

• Interest rate: Primarily dependent on the yield curve and the MCLR plus the adjusted spread. In India, typically financing may be offered between 14% and 20%.

• Collateral: venture debt providers usually require a lien on assets of the borrower like IP or the company itself, except for equipment loans where the capital assets acquired may be used as collateral.

• Warrant coverage: the lender may request warrants over equity ranging between 5% to 20% of the total loan value. A certain percentage of the loan’s face value can be converted into equity at the per-share price of the last (or concurrent) venture financing round. The warrants are usually exercised during company acquisition or IPO listing in the exchange, yielding an ‘equity kicker’ return to the lender.

• Rights to invest: On occasion, the lender may also seek to obtain some rights to invest in the borrower’s subsequent equity round on the same terms, conditions and pricing offered to its investors in those rounds. It is expected that Convertible Debt market will significantly rise in the future.

• Covenants: borrowers face fewer operational restrictions or covenants with venture debt. Accounts receivable loans will typically include some minimum profitability or cash flow covenants.

Private placements and HNIs

Capital markets, currently, are not an attractive option to park funds for growth. So, investors such as corporate firms present in the incumbent’s value chain, HNI Investors and even Limited Partners (LP) can probably push funds into startupss and MSMEs to diversify their portfolio and leverage strategic advantages to their favour. Larger firms working with the incumbent may propose a board member position as a return value of their funds. Be it upstream or downstream, they may see the incumbent’s business model as a potential target for acquisition and would want to be at the driver seat in managing the startups.

Experienced mentorship and limited dilution are the major positive angles for the startups planning to raise funds from these investors. But the promoters should also stay beware of financial frauds and keep a strong check on legal requirements. As per regulatory compliances, funds raised from less than 200 investors qualify for private placement whereas that from more than 200 investors would push it to a crowdfunding platform and enable a separate set of compliance.

Crowdfunding

Business models that have either a component of societal welfare attached to its value proposition or solutions to help the society in the crisis are ideal for availing crowdfunding opportunities. Crowdfunding doesn’t involve complicated financial risks as an investment for retail investors generally is significantly small as compared to institutional players. Moreover, the campaign could go viral and thereby, reduce marketing and advertising expenses from the P&L statement. The campaign itself acts as a testimony to the business model.

Moreover, the promoters don’t dilute their share in the firm as the beneficiaries can be rewarded back later with various forms of rewards.

But founders also need to keep in mind the effort and time required to increase the appeal of the model as well as generate sufficient PR content in quick succession. Sensitive assets such as tech algorithms, IP, trade secrets governing the model need to be protected with trademarks, copyrights, and patents. Otherwise, the campaign runs the risk of losing its competitive advantage due to imitation.

As a rule of thumb, the promoters should also consider a 5-8% of funds raised as crowdfunding expenses as both the funding platform and payment gateways shall place their own charges.

Conclusion

Public source of funds over private funds:Government of India may deploy the second round of stimulus package targeted exclusively for the MSME sector and startups. There has been a global wave, across national funds, to aid startups and small businesses thrive in the current situation. In a bearish market, private investors impose extraordinarily conservative or stringent measures to fund startupsand put a strong push to focus on profitability instead of growth. In the Early Stage, even if it sounds attractive, this may be severely detrimental in the long run.

Moreover, raising funds from such schemes imperatively offer benefits beyond monetary terms. Firstly, the access to key policymakers and decision-making units of planning bodies and the cushion to stay ahead of the curve for alignment with governance procedures. Moreover, the funding may achieve a significantly lower cost of capital. It shall help to re-model the capital structure of the business for a healthy financial scorecard.

Venture debt financing over equity financing:Venture debt ensures that founders need not comply with an over-dilution as the pandemic suppresses business valuations. Venture debt can be used as a temporary bridge to maintain or improve growth models and operational scalability until the onset of a bull market. The up-cycle inevitably attracts equity financiers and a healthy business model reaps the maximum benefits then. The Cost of capital is also lower than equity financing and thus, shareholder returns don’t get affected much.

On a cautionary note, venture debt firms will look for the relevant risk as compared to the asset class, so unit economics and asset utilization shall play a critical role in the capital deployment decision.

Authored by: Rajarshi Chowdhury

About Intueri: Intueri Consulting is a management consulting firm with nearly 100 man-years ofexperience in managing organizational challenges, including managing firms and clients throughsome of history’s biggest crisis periods such as the 1997 Asian Financial Crisis, 9/11 led crisis, 2007-08 global financial crisis. This vast repository of organizational management experience, accrued bysenior management, over decades of managing large multinational firms and clients enables Intuerito develop effective, efficient crisis management strategies and provides it with a unique perspectiveinto events and decisions that take into consideration all important aspects of a firm, includingassessment of primary, secondary and even tertiary order potential effects on the firm on account ofimplementation of strategies.Intueri has been helping organizations of a different scale to raise funds in a hyper-competitive ecosystem and has prepared an end to end value offering for an investor roundtable. The firm has consultants, well balanced with the domain knowledge and cross-sectoral industry analysis approach and possesses a strong network of financial advisors.

Feel free to reach out to us for a detailed discussion.

Reference:

- https://www.cbinsights.com/research/cockroach-startups-turned-unicorns/

- https://m.economictimes.com/small-biz/startups/newsbuzz/covid-19-impact-early-stage-financing-rounds-fall-30-37/articleshow/74922585.cms

- https://www.vccircle.com/how-vc-dealmaking-across-stages-fared-in-jan-march-as-virus-scare-intensified/

- https://www.vccircle.com/how-vc-dealmaking-across-stages-fared-in-jan-march-as-virus-scare-intensified/

- https://retail.economictimes.indiatimes.com/news/industry/28979-startups-recognised-by-dpiit-as-on-march-1-piyush-goyal/74575691

- https://retail.economictimes.indiatimes.com/news/industry/startups-want-csr-funds-govt-support-to-overcome-covid-19-impact/74959129

- https://tech.economictimes.indiatimes.com/news/startups/vcs-want-sidbi-to-ease-sops-criteria/75017536

- https://www.moneycontrol.com/news/business/startup/coronavirus-impact-startups-seek-longer-time-to-pay-back-venture-debt-firms-5115321.html

- https://en.wikipedia.org/wiki/Venture_debt

- https://en.wikipedia.org/wiki/Venture_debt

- https://en.wikipedia.org/wiki/Venture_debt